We will close the loop on waste by 2030

Closed Loop Partners finds the "take-make-waste" cycle giving way to a new model just as powerful as the rise of solar and wind energy.

On Labor Day, a typical American shopper bought a bag of chips, a tub of salsa and a six-pack to bring to a friend’s barbeque. Behind that purchase are a variety of actors, including brands, retailers and packaging manufacturers.

If that shopper does not recycle, instead disposing of the empty bag and tub in the trash, the shopper will add to a growing problem of vast amounts of waste floating in our oceans, littering parks and filling landfills.

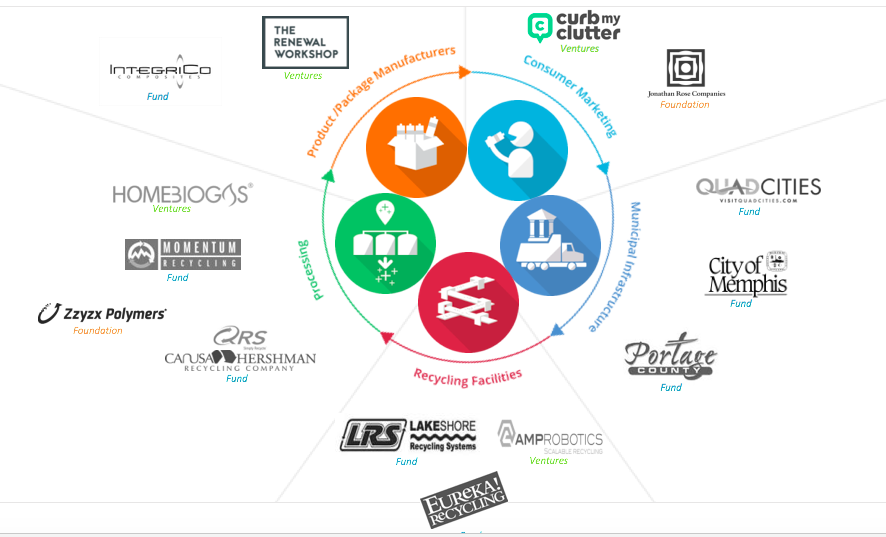

Solutions to this problem exist. The development of circular supply chains — closing the loop on consumer packaging and post-consumer waste by connecting consumers, municipal recycling infrastructure and product manufacturing — at massive scale would provide the following benefits annually:

- Save cities more than $20 billion.

- Reduce greenhouse gas (GHG) emissions by more than 500 million tons of CO2 (equivalent).

- Drive revenues of at least half a trillion dollars across multiple industries.

How we will get there

Simply put, we need to follow the money. We at Closed Loop Partners see opportunities for new markets, sources of profit and value creation when products and packaging are returned to supply chains. We are demonstrating that investment in circular business models generates market rate returns and creates replicable solutions at scale.

Our aim is to unlock a much larger pool of capital from traditional and mainstream investors. During the past three years, Closed Loop Fund has invested more than $30 million. Results include:We are witnessing the emergence of a new wave of innovation and investment that is disrupting old models.

- Memphis has saved nearly $200,000 in less than a year by expanding curbside recycling collection to more than 100,000 households.

- Lakeshore Recycling has diverted nearly 100,000 tons of recycled material for the Chicago area in 18 months, helping to reduce GHG emissions by almost 250,000 metric tons of CO2 (equivalent to taking 35,000 cars off the road for that time).

- IntegriCo is doubling its capacity to manufacture railroad ties out of post-consumer waste plastics to more than 200,000 railroad ties (or more than 60 miles of ties) per year.

Each dollar invested by the fund has attracted $3 of co-investment from financial partners, including commercial lenders, municipal bonds, private equity and impact investors. Our portfolio projects have put $100 million to use toward circular production. Over the same period, more than $30 billion has been deployed into waste, recycling and related manufacturing by both private and public sources.

We are witnessing the emergence of a new wave of innovation and investment that is disrupting old models. Like the emergence of solar and wind as viable alternatives to oil and gas, or car sharing as an alternative to ownership, closed loop supply chains are disrupting "take-make-waste" models of production and consumption. This new wave is transforming what we think of today as waste into a sustainable and profitable cycle of production and consumption.

Over the past several months, we have been conducting research on the current capital landscape for recycling infrastructure and circular supply chain innovation, as well as what’s needed to drive a more circular system. Our research includes data from capital providers, capital seekers and other stakeholders across the system. In the coming weeks, Closed Loop Partners will share insights from those actively deploying capital today, as well as those who have capital "waiting in the wings," with the aim of helping investors better understand the trends, challenges and opportunities.The opportunities for impact and financial returns should make investors, brand owners, policymakers, recyclers, manufacturers and entrepreneurs take note.

Where capital needs to go

The "take-make-waste" pattern of production and consumption has meant under-investment in basic recycling infrastructure and a gross imbalance of capacity. Total available landfill capacity in the United States is 8.5 billion tons of solid waste, yet our capacity to process recycled plastic, paper and glass is a small fraction of the amount we can landfill. This will have to change.

Solutions are in various stages of development and scale, requiring different types of capital. Some examples:

- Basic collection infrastructure (via carts and trucks) or sorting capacity (via material recovery facilities) often can be financed with public or private debt.

- Emerging technologies (robotics, chemical depolymerization) require venture capital to commercialize. At the earliest stages, angel investments, philanthropy and public grants are also critical.

- Strategic capital (including acquisitions or joint ventures) help to advance vertically integrated models and are one way to overcome the lack of long-term contracts in the industry.

Reasons to believe

The opportunities for impact and financial returns should make investors, brand owners, policymakers, recyclers, manufacturers and entrepreneurs take note. In the United States alone, building a closed loop infrastructure would touch a host of economic activities including waste collection (what we think of as municipal solid waste or post-consumer waste), sorting of recyclable material into saleable commodities, processing of material into feedstocks for specific end-markets and manufacturing using post-consumer content. Today, these industries represent well over $1 trillion in revenues each year.

Sound impossible? We’ve done this before. In the 1990s, U.S. cities invested $10 billion in infrastructure to support paper recycling.We imagine a world in which everyday consumer products and packaging becomes another product.

Today, more than 60 percent of paper and paperboard is recycled in the United States, and the material is one of the most efficient recycled materials markets. In addition, the paper products manufacturing industry generates nearly $300 billion each year in revenue. Virgin and recycled paper pulp are used nearly interchangeably; consumers are virtually agnostic. It is important to note the transformation that took place 20 years ago with paper benefited from subsidies and investment by public entities.

2030 will look very different

We imagine a world in which everyday consumer products and packaging becomes another product. In order to achieve that vision, capital is needed. As investors, that’s the opportunity we see before us in the next wave of circular investing. By putting more capital to work, we expect to see a circular infrastructure by 2030 that looks very different from what we see today:

- Post-consumer recycled material is at parity with virgin material, in terms of cost and quality.

- Material is in demand for a variety of end uses.

- Processing technologies are so advanced that we can effectively keep molecules at play, rather than losing them to landfill.

- The system efficiently transforms "waste" resources into commodities of value.

- Each player in the value chain stands to benefit when the loop is closed.